VisionaryPoint.

The Role of GRC in Corporate Governance.

Unlock GRC Series

Episode #03

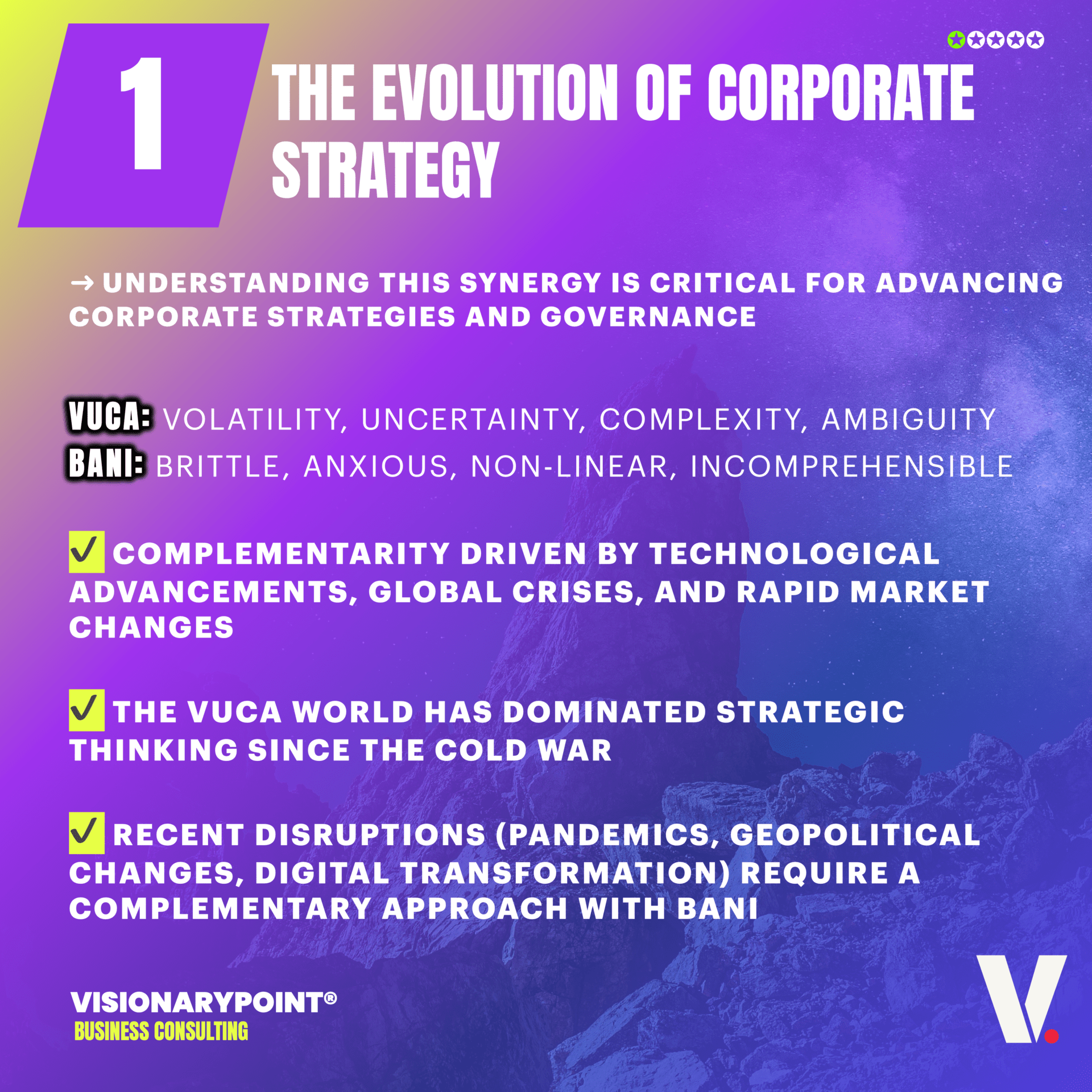

From VUCA to BANI. A Unified Approach to Meet Future Challenges.

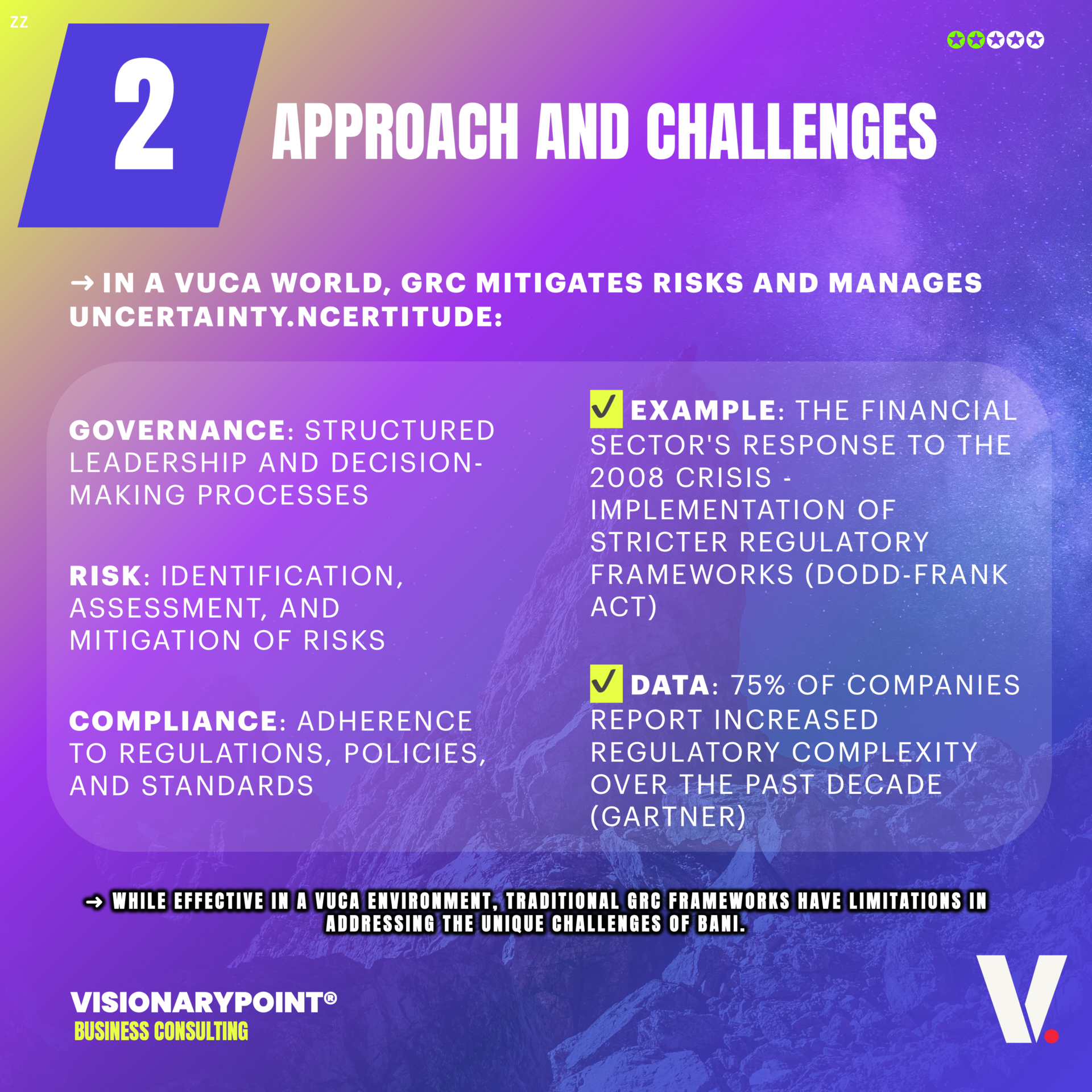

In today’s economic ecosystem, we are witnessing a fundamental shift from the VUCA (Volatile, Uncertain, Complex, Ambiguous) paradigm to a BANI (Brittle, Anxious, Nonlinear, Incomprehensible) world. This evolution has profound implications for Governance, Risk, and Compliance (GRC), transforming this field into an essential strategic lever. Beyond its traditional role as a safeguard, GRC emerges as a catalyst for innovation and a driver of sustainable value creation. This article explores the foundations of robust corporate governance focused on GRC and examines how an integrated approach can not only enhance organizational resilience but also drive long-term growth in the context of digital transformation and increased social responsibility.

From VUCA…

The VUCA model, initially developed by the US Army War College, has long served as a framework for understanding the post-Cold War business environment. It described a world characterized by:

- V = Volatility – rapid and unpredictable changes

- U = Uncertainty – a lack of predictability and clear perspectives

- C = Complexity – multiple interconnected forces that are difficult to untangle

- A = Ambiguity – a lack of clarity about the meaning of events

In this context, GRC focused on creating robust and flexible systems capable of quickly adapting to changes and managing uncertainty.

…to BANI

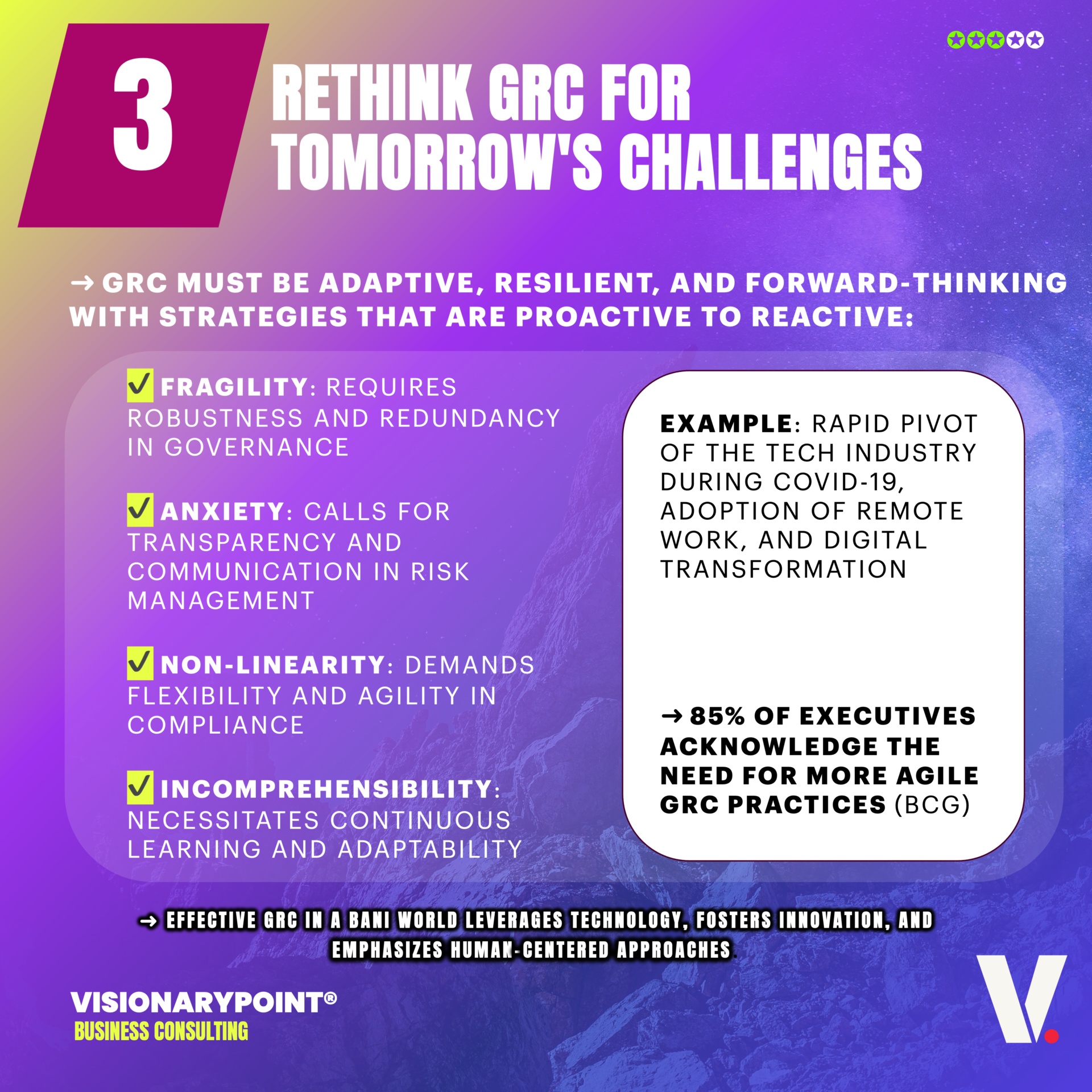

However, recent events, such as the COVID-19 pandemic, climate crises, and geopolitical upheavals, have revealed the limitations of the VUCA model. Jamais Cascio proposed the BANI concept as a more fitting description of our current reality:

- B = Brittle – seemingly solid systems can suddenly collapse

- A = Anxious – a constant state of worry and stress about the future

- N = Nonlinear – disproportionate effects compared to causes

- I = Incomprehensible – complexity that exceeds our capacity for understanding

Combine VUCA and BANI for a Comprehensive GRC Framework

By combining the ideas of VUCA and BANI, we can develop a more holistic approach to GRC that addresses both the known challenges of volatility, uncertainty, complexity, and ambiguity, as well as the emerging realities of brittleness, anxiety, nonlinearity, and incomprehensibility. This unified approach allows us to:

• Build resilient systems that can withstand sudden shocks and collapses.

• Promote a culture of awareness to manage anxiety and stress within organizations.

• Develop adaptive strategies to respond to disproportionate and nonlinear impacts.

• Enhance our ability to navigate complexity with advanced analytical tools and frameworks.

Beyond Corporate Governance.

Importance of Leadership

Ethical and visionary leadership is the cornerstone of effective corporate governance. According to a recent Deloitte study, 87% of leading companies attribute their success to strong GRC leadership. These leaders embody what is called the “tone at the top,” setting high standards of integrity and accountability that cascade throughout the organization.

In a BANI environment, leadership must evolve towards what is called “conscious adaptive leadership.” This leadership style recognizes the limits of forecasting and long-term planning and focuses on creating an organizational culture that can quickly adapt and thrive amid uncertainty.

Satya Nadella’s Adaptation at Microsoft

Under Satya Nadella’s leadership, Microsoft adopted a “growth mindset” culture, encouraging continuous learning and rapid adaptation. This approach enabled the company to effectively pivot to cloud computing and successfully navigate the BANI environment of the tech industry.

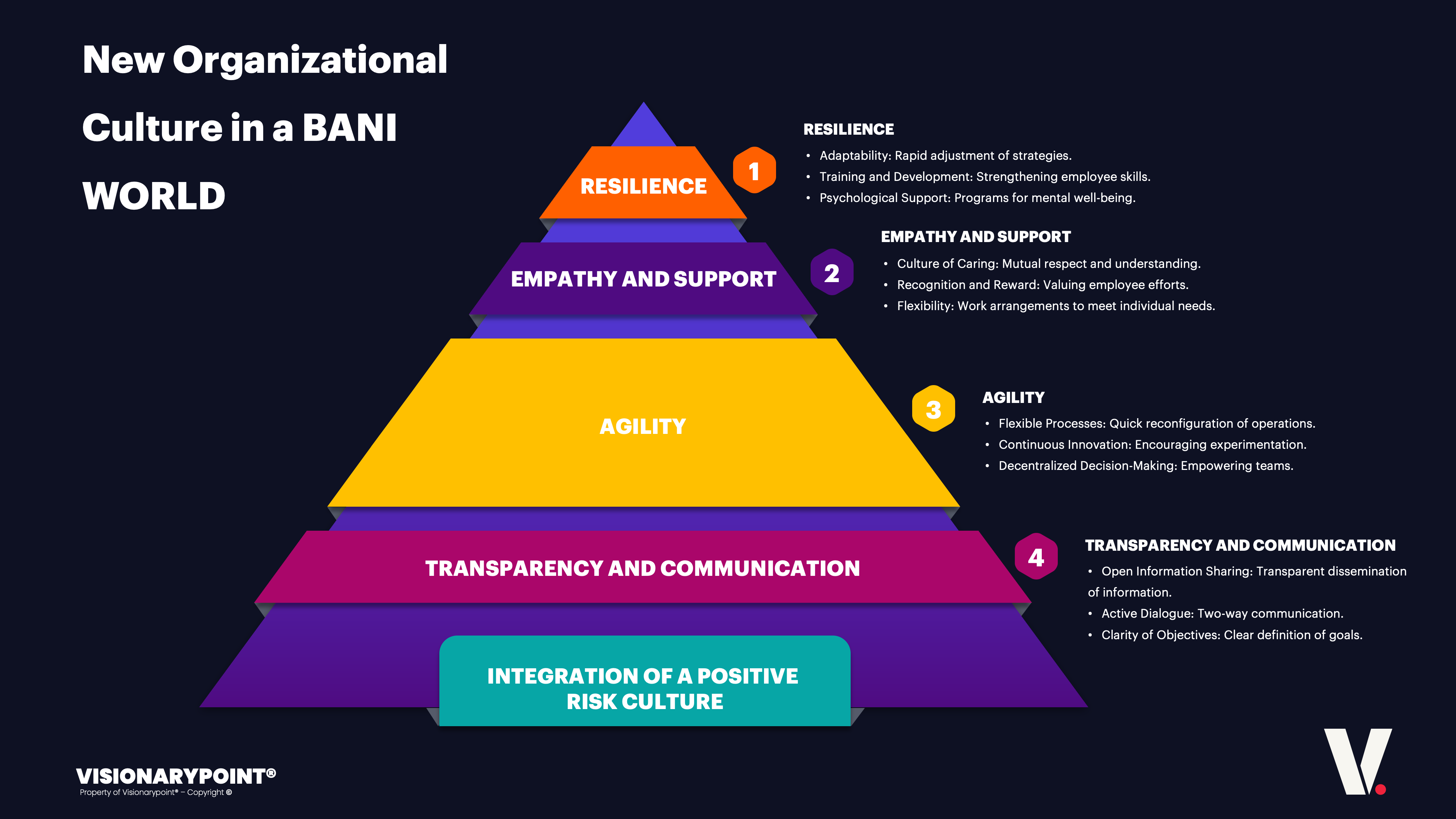

Organizational Culture

Corporate culture is the fertile ground in which GRC practices take root. The concept of “positive risk culture,” developed by psychologist James Reason, encourages a proactive approach to risk management. For example, Google implemented its “Googler-to-Googler” program, where employees train their peers on various aspects of ethics and compliance, thereby creating a culture of shared responsibility.

Corporate Culture

Redesign Governance Structure.

Corporate culture is the fertile ground in which GRC practices take root. The concept of “positive risk culture,” developed by psychologist James Reason, encourages a proactive approach to risk management. For example, Google implemented its “Googler-to-Googler” program, where employees train their peers on various aspects of ethics and compliance, thereby creating a culture of shared responsibility.

Board of Directors

An effective board of directors acts as the “collective brain” of the company. The cognitive diversity theory, proposed by Scott E. Page, suggests that a diverse board brings a variety of perspectives, thereby enhancing the quality of strategic decisions. For instance, Salesforce’s board, known for its diversity, played a crucial role in navigating the company through the challenges of the pandemic and its commitment to pay equity.

Specialized Committees

Specialized committees act as the “sensory organs” of the organization, detecting and analyzing weak signals that might escape general oversight. The concept of “adaptive governance,” popularized by Elinor Ostrom, highlights the importance of flexible structures capable of quickly adapting to environmental changes.

In a BANI world, governance structures must become more fluid and adaptive. The concept of “liquid governance,” inspired by Zygmunt Bauman’s work, proposes structures capable of rapidly reconfiguring in response to emerging challenges.

Holacracy at Zappos

Zappos’ adoption of holacracy illustrates this approach of fluid governance, enabling decentralized decision-making and rapid adaptation to market changes.

Implement Responsive Policies and Procedures.

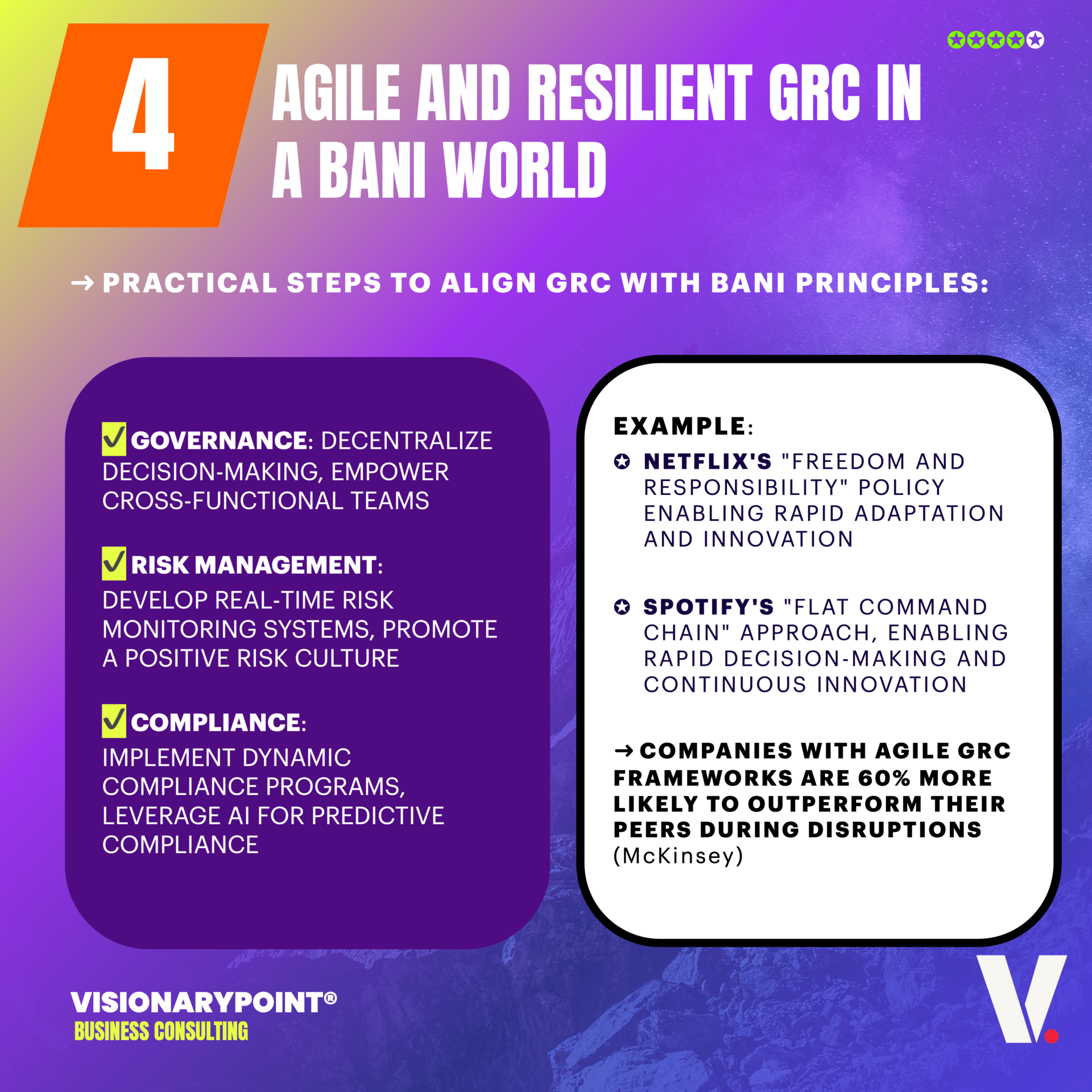

Policy Development

Effective policies act as an internal “constitution” for the company. The concept of “living policy,” inspired by Karl Weick’s work on organizational sensemaking, encourages dynamic policies that evolve based on feedback and environmental changes. Netflix, for example, adopted an innovative approach with its “freedom and responsibility” policy, which prioritizes employee judgment over rigid rules.

In a BANI world, policies and procedures must be designed as “complex adaptive systems,” capable of organically evolving in response to environmental changes.

Flexible Work Policy at Unilever

Unilever implemented a “U-Work” flexible work policy, reflecting the adaptability needed in a BANI world.

Implementation and Monitoring

Effective implementation of policies requires what I call “compliance orchestration.” This approach integrates technology, processes, and people into a coherent system. The use of artificial intelligence for compliance monitoring, as UBS does with its system for detecting suspicious transactions, exemplifies this advanced orchestration.

Excel in Risk Management.

Risk Identification and Assessment

Risk identification and assessment are akin to a “dynamic mapping” of the company’s environment. The concept of “emerging risk,” developed by the World Economic Forum, underscores the importance of scanning the horizon for future threats. Companies like Shell use advanced scenario planning techniques to anticipate and prepare for various possible futures.

Risk management in a BANI environment requires an approach known as “quantum risk management,” acknowledging that some risks can exist simultaneously in multiple states and that the act of measuring them can alter them.

Risk Response and Mitigation

Responding to risks should be viewed as a “strategic chess game,” where each move is calculated to maximize resilience and minimize vulnerabilities. The concept of “adaptive resilience,” proposed by Andrew Zolli, encourages companies to develop bounce-back capabilities in the face of shocks. Airbnb’s response to the COVID-19 crisis, quickly pivoting to long-term rentals and online experiences, illustrates this strategic agility.

BlackRock’s Risk Management Approach

BlackRock uses advanced stress testing models that incorporate highly unlikely scenarios and nonlinear contagion effects, reflecting the BANI nature of modern financial risks.

Promote Communication and Transparency.

Internal Communication

Effective internal communication acts as the “nervous system” of the organization, rapidly transmitting crucial information to all parts of the organizational body. The concept of “narrative communication” developed by David Boje highlights the importance of creating coherent stories around GRC initiatives to foster employee engagement.

In a BANI world, communication must be continuous, transparent, and multichannel. The concept of “empathetic communication” becomes crucial to managing anxiety and maintaining trust.

Airbnb’s Crisis Communication During the Pandemic

Airbnb’s response to the COVID-19 crisis, with frequent and empathetic communications from its CEO Brian Chesky, illustrates this approach adapted to a BANI environment.

External Transparency

It is essential to communicate clearly and concisely with internal and external stakeholders regarding GRC-related activities and initiatives. For example, BMW regularly organizes information sessions for its employees to raise awareness about GRC issues and gather their feedback.

Publishing transparent reports demonstrates commitment to transparency and accountability. In this regard, TotalEnergies annually publishes a detailed report on its risk management policy and internal control system, audited by an external firm.

Engaging stakeholders strengthens the effectiveness and legitimacy of governance processes. SNCF has set up an « ethics and CSR committee » composed of representatives from customers, suppliers, and NGOs to identify non-financial issues and co-design its action plans.

It is also important to ensure transparency with shareholders, as L’Oréal does by presenting annually to the board of directors a comprehensive report on the assessment and treatment of key emerging risks.

Constructive exchanges with regulators, like those organized by Crédit Agricole, help proactively evolve the internal control system. Finally, Michelin surveys NGOs, directors, and analysts about their perception of its CSR risk management.

Support Strategic Decision Making.

Anticipate Issues

Anticipate issues can be compared to a “strategic radar,” allowing the detection of opportunities and threats on the horizon. The concept of “weak signals” developed by Igor Ansoff emphasizes the importance of detecting early signs of change. Companies like Amazon, with its “Day 1” approach maintaining constant vigilance against potential disruptions, illustrate this anticipatory mindset.

Align with Strategic Objectives

Align GRC with strategic objectives creates an “organizational symphony,” where every part of the company works in harmony towards a common goal. The Balanced Scorecard, developed by Robert Kaplan and David Norton, provides a framework for this alignment. Siemens, for example, has integrated GRC performance indicators into its strategic dashboard, ensuring that compliance and risk management are treated on par with financial and operational goals.

Enhance Operational Performance.

Cost Reduction

Cost reduction through GRC can be viewed as “organizational precision surgery,” eliminating inefficiencies without compromising vital functions. The concept of “lean compliance,” inspired by lean management, aims to simplify compliance processes while maintaining their effectiveness. Companies like Toyota have applied these principles to their GRC, achieving substantial savings while improving compliance quality.

Resource Optimization

Resource optimization through GRC acts as an “efficiency catalyst,” maximizing the return on investment for every dollar spent. Eliyahu Goldratt’s Theory of Constraints offers a framework for identifying and removing bottlenecks in GRC processes. For example, Johnson & Johnson uses predictive analytics to optimize compliance resource allocation, focusing efforts where they will have the greatest impact.

Strengthen Organizational Resilience.

Crisis Preparedness

Crisis preparedness can be likened to an “organizational immune system,” bolstering the company’s defenses against external shocks. The concept of “antifragility” developed by Nassim Nicholas Taleb suggests that some systems can not only withstand shocks but also become stronger from them. Zoom’s response to the pandemic, where the company rapidly strengthened its security protocols in the face of explosive demand, illustrates this ability to adapt under pressure.

Adaptability and Innovation

Adaptability and innovation in GRC function as an “evolutionary engine” for the organization, enabling it to adapt and thrive in a constantly changing environment. Clayton Christensen’s concept of “disruptive innovation” can be applied to GRC, encouraging radically new approaches to risk management and compliance. Tesla, for example, has integrated risk management into its innovation process, allowing it to quickly develop new technologies while navigating a complex regulatory landscape.

Go Beyond GRC.

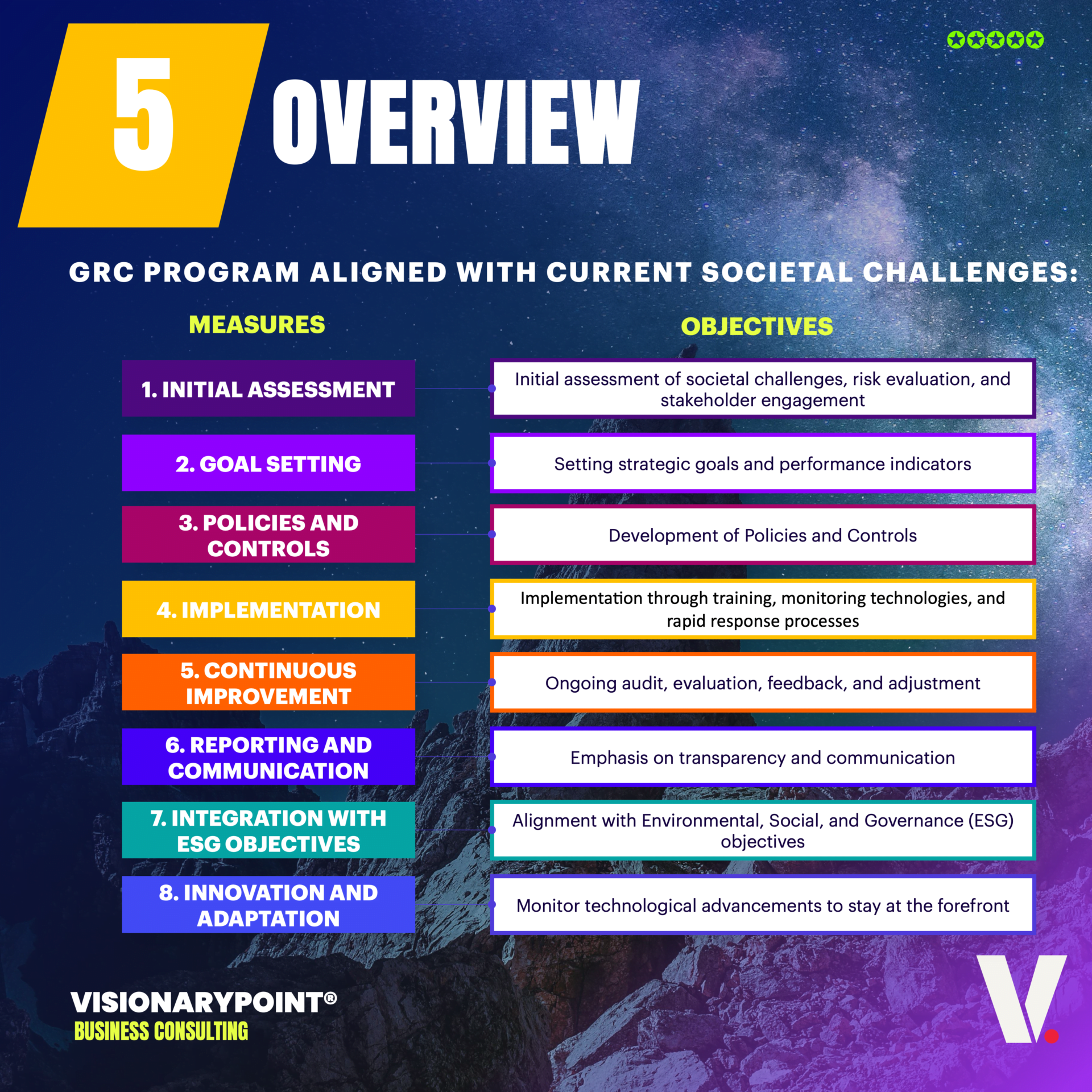

At the dawn of the Fourth Industrial Revolution and in an increasingly BANI world, GRC is poised to play an even more crucial role in corporate strategy. Here are some emerging trends and recommendations for companies looking to strengthen their GRC approach:

Future Perspectives and Recommendations

AI-Augmented GRC

Artificial intelligence and machine learning will revolutionize GRC, enabling predictive risk analysis and real-time compliance. Companies should invest in these technologies to remain competitive.

Ethical and Responsible GRC

With the growing importance of ESG (Environmental, Social, Governance) criteria, GRC must incorporate ethical and sustainability considerations. Companies should develop what I call an “organizational conscience” aligned with societal and environmental values. This approach goes beyond mere compliance to embrace true corporate responsibility.

Collaborative GRC

The increasing complexity of risks in a BANI environment necessitates a collaborative approach to GRC, involving inter-company and public-private partnerships. Companies should explore “networked GRC” models to pool resources and knowledge. For example, the World Economic Forum has launched an initiative to share cyber risk information among large companies, illustrating this trend toward more collaborative GRC.

Agile GRC

In a BANI world, GRC must adopt agile principles to quickly adapt to changes. Companies should implement regular “GRC sprints” to reassess and adjust their strategies. Spotify, for instance, has applied its agile “squads and tribes” model to its risk management function, enabling rapid adaptation to new regulatory and security challenges.

Quantified GRC

Increased use of data and advanced analytics will enable more precise quantification of risks and opportunities. Companies must develop a “data culture” within their GRC function. Goldman Sachs, for example, uses machine learning algorithms to analyze millions of transactions and identify money laundering risks with increased accuracy.

GRC Integrated with Employee Experience

In a BANI world characterized by anxiety, GRC must be seamlessly integrated into employees’ daily experiences. User-friendly GRC tools and immersive training using virtual reality can help embed compliance and risk management practices into the corporate culture.

Resilience-Focused GRC

Beyond risk management, GRC should focus on strengthening overall organizational resilience. This involves developing rapid adaptation and recovery capabilities in the face of unexpected shocks. Unilever, for instance, has implemented a “Resilience Index” to measure and improve its ability to respond to disruptions in its global supply chain.

Future-Oriented GRC

In a non-linear and incomprehensible environment, GRC must adopt forward-looking approaches. The use of “strategic foresight” techniques, like those employed by Shell in its energy scenarios, can help companies prepare for various possible futures.

Focus on ESG

Ethical and Responsible GRC

Integration of ESG Criteria

Companies must integrate ESG criteria into their risk management and decision-making processes. For example, Unilever has implemented a “Sustainable Living Plan” that integrates sustainability goals into all aspects of its operations, from supply chain to product development.

AI and Data Ethics

With the increasing use of AI and big data, companies must develop robust ethical frameworks for the use of these technologies. Google, for instance, has published AI ethics principles and established an external advisory board to guide the ethical development of its technologies.

Climate Governance

Companies must integrate climate-related risks and opportunities into their GRC framework. The Task Force on Climate-related Financial Disclosures (TCFD) provides a framework for this integration. Companies like BNP Paribas have adopted these recommendations, integrating climate risks into their overall risk management.

Human Rights and Supply Chain

GRC must extend to managing human rights risks in the supply chain. Nike, after facing criticism for its labor practices, developed a comprehensive system to monitor and improve working conditions at its suppliers.

Diversity and Inclusion

GRC should actively promote diversity and inclusion as key elements of risk management and innovation. Salesforce, for example, conducts regular pay equity audits and has integrated diversity goals into its overall strategy.

Transparency and Reporting

Companies must adopt transparent reporting practices on their ESG performance. Patagonia, for example, publishes a “Footprint Chronicles” detailing the environmental and social impact of its products.

Ethical Culture

GRC should promote a strong ethical culture at all levels of the organization. Siemens, after facing corruption scandals, implemented a comprehensive compliance and ethics program, integrating these values into its corporate culture.

Stakeholder Engagement

Ethical GRC involves proactive engagement with all stakeholders. Unilever, for example, has established a “Sustainable Living Advisory Council” composed of external experts to guide its sustainability strategy.

Responsible Innovation

GRC must encourage innovation while ensuring it is conducted responsibly. Philips, for example, has integrated sustainability criteria into its product development process, fostering innovation in sustainable health technologies.

Impact Measurement

Companies must develop robust metrics to measure their ESG impact. Danone, with its “Manifesto Brand” model, measures not only its financial performance but also its social and environmental impact.

Conclusion

GRC as a Catalyst for Transformation in a BANI World.

The shift to a BANI world represents both a challenge and an opportunity for the GRC function. By embracing this new reality, GRC can transform from a control function into a true catalyst for innovation and organizational transformation.

GRC in a BANI world is no longer merely a set of processes and controls but an organizational philosophy that permeates every aspect of the business. Organizations that succeed in this new paradigm will be those that see GRC not as a constraint but as a driver of innovation, adaptability, and sustainable value creation.

For consulting firms, this evolution represents a unique opportunity to position themselves as essential strategic partners. By helping companies navigate this new BANI reality through a transformed GRC, consultants can play a crucial role in shaping the future of corporate governance and organizational resilience.